A guide to organizing your digital life

- Jennie

- Jan 5, 2023

- 7 min read

Updated: Jan 6, 2023

How to start the New Year with an organized email inbox, managing your paid subscriptions, and decluttering your digital photos.

First up, let's tackle your inbox. Do you need a promo code weekly from a place you bought a shirt from once? Also, we get it Southwest Airlines, you are having a sale! Free up some time on deleting your mail daily by removing these from your inbox. No one wants to be the person with 1000+ unread emails. Luckily there are plenty of free apps out there to help with this. I used UnrollMe to tackle this project.

Let's Unroll!

Download the UnrollMe app or navigate to UnrollMe

UnrollMe helps you categorize your inbox into three categories Keep, Unsubscribe, and Rollup. It's truly that simple. You can use the bulk function to do this quickly between each of the categories. Simply keep the emails you still want to see, unsubscribe from those that are cluttering up your inbox, and roll up the ones you just want a daily summary on (far less clutter, but gives you a chance to see the things you may want to be reminded of occasionally.) I was shocked at the things I was subscribed to that I was not aware of, and I had 63 subscriptions, I unsubscribed from 55 of the, rolled up 5, and kept 3. You can repeat this process with multiple emails

Quick note, Unroll.Me is compatible with Gmail, Outlook, Yahoo, iCloud & AOL. Do you use do, delegate or delete? Any interest in how to further keep your personal and professional emails organized?

Interested in Email organization and filing tips?

You've got mail - YES!

I like having 100+ unread emails - No

Managing Paid Subscriptions

The one thing about cutting the cord is that I have found that people end up paying more. Different streaming platforms offer shows and we often do not reevaluate if we are still watching the content or music we are paying for monthly. Maybe you don't miss the ten dollars a month, but if its two two streaming platforms, that's $240 a year. I would love that $240 to put towards the kid's Christmas. We realized we were paying for Sirus XM, apple music, and Spotify. I rarely even listen to music and just assumed my husband was using our family share for Apple music. So much wasted spend. Additionally, when is the last time you negotiated your cell phone or internet bill? What about home security? I decided to tackle these together, so where do you start? I highly suggest using an app such as Mint or Rocket money. I have been a long-time user of Mint for our finances, but I also took this time to sign up for Rocket money to test out the look and feel of that.

"On average, $86 per month was the initial amount consumers estimated they spent on subscription services. But upon closer look at their itemized expenses, the average monthly spend for consumers was more than 2.5 times the amount they thought at $219 – a whopping $133 higher than their original estimate" – C + R RESEARCH

Mint is great for keeping track of all your spending. Cash, credit cards, outstanding loans, savings, investments, and property. You can set budgets, and it tracks how you are spending against those. I could do a whole post on that. It does take some time to add each account so that all spending pulls in but once it is done, it's seamless from there. If you are not already a user, you will have to sign up, but once that is complete, follow the below navigation tips.

Negotiating subscriptions down - Mint partners with Billshark, and after you enter some information they need, Billshark will go and try and negotiate bills down for you. I would only use this for subscriptions you 100% intend to keep such as your internet or wireless phone bills. Billshark takes 40% of whatever they save you. If they save you nothing, you pay nothing. The remaining 60% goes into your pocket.

Canceling subscriptions- Under the subscriptions tab, Mint will pull in all your subscriptions. It did pull in a couple of things here that were wrong like my monthly HOA. It does offer the ability to cancel for you, but you have to upgrade to a premium member, and as I am trying to save money the $4.99/mo to access this premium feature did not seem worth it for the couple subscriptions I intended to fully cancel. It was great though to see all subscriptions you were paying monthly. I had no idea I was paying for PBS Kids through Prime. My son must have clicked that while watching Daniel Tiger, a show he probably has not watched in two years. It took me 10 seconds to cancel through Amazon

Next up, Rocket Money!

As mentioned I was not a current user of Rocket Money, but it offers a similar product to Mint, so I gave it a try. The sign-up was pretty quick (steps shown below) and because I only am currently using this product to manage paid subscriptions, I only connected bank accounts or credit cards I knew were used for payment. Not having to add my mortgage company and 401K's saved a ton of time. I did love the look and feel of it so I am going to go back later and see all it has to offer.

Negotiating subscriptions down - Under the dashboard section, navigate to lower your bills as shown in the last picture in the gallery above. It will either ask for login credentials or a copy of the bill to use this feature for you. I did have to agree to a free 7-day trial to use this feature. After the 7 days, you pick an amount that seems fair to bill monthly, the average was $7. Truthfully, I signed up, negotiated the bills I wanted to, and immediately canceled my free trial. Once I understand their premium content later, I may resubscribe but did not want to lose focus on my money-saving mission. Rocket Money has an 85% rate of success in negotiating subscriptions to a lower amount, so it was worth the try. Much like Billshark, it takes 40% of the cut and you keep 60%. The big difference here is if they do save you the money, they take their cut upfront, so in the short term you might actually be out cash. If you can burden the hit though, in the long run, it's worth it.

Canceling subscriptions- Rocket Money does not cancel subscriptions for you, however, it goes provides guides on where to navigate or call to get the task done for more common subscriptions. I found this incredibly helpful and was a great feature. It also had quick links to the website and phone number. A sample is below.

I was very impressed with Rocket Money and I will definitely be exploring them for my personal budgeting and money management this year.

Digital Photo Clean Up

Every year one of my resolutions is that I am going to stay on top of my phone's photos. Having multiple kids, sometimes it takes a lot of photos to get the right shot. Where I am terrible is going back after you get the shot and deleting the less photo-worthy pictures. I do good for about a week and then it's back to bad habits. Even if you can commit to it monthly, there will be less to sort through at the end of the year. I wonder how much of the photo storage I pay for are blurry shots of my kids, screenshots of random things, or the ever-fun 800 burst photos my daughter took of herself when she got her hands on my phone. A blurry Christmas photo like the one below does not need to be held onto.

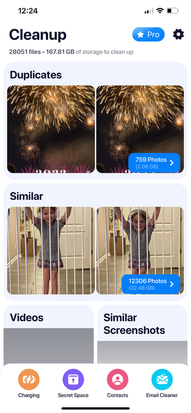

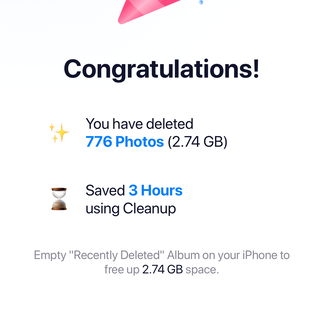

Seeing how bad the task was in front of me, I decided to enlist the use of an app to help me along. After a quick search, I downloaded Cleanup: Phone Storage Cleaner. After scanning your phone, to officially perform some of the cleanups, you do need to pay. They offered a free 3-day trial which I planned on canceling after using it, but after getting some of the low-hanging fruit out of my photos, I did decide that I might want to spend some time picking some similar photos out and not necessarily trusting the ones they suggest and ended up purchasing the weekly option. The weekly option was $4.99 and the lifetime was $39.99. I put a reminder in the calendar to cancel next week, and am going to commit to cleaning up my photos. We are traveling for a wedding this weekend, so two 4-hour flights there and back should help me accomplish that. Additionally, reviewing videos is almost like a dating app, with swiping left to delete and right to keep and I wanted to not rush this sort of either. The other photos section worked similarly, so the weekly option seemed perfect.

A quick run-through of what I accomplished immediately

1) Duplicates - I had a ton of these since many of my favorites I edited in lightroom but did not save over the original file.

2) Similar screenshots - I went ahead and deleted all of these as I cannot think of any screenshots I would have been attached to.

3) Other Screenshots - I deleted all of them except recent screenshots I took for this blog post.

The app says I saved over 4 hours of cleanup time, and the entire process so far took me 5-10 minutes, most of which was waiting for the photos to delete.

Pro-Tip - Actually Print your Photos

Commit to printing some of your favorites. Create an album of photos that you want to print, and refresh your frames or albums. I prefer MPIX, as I think their print quality is higher. Another great option is to seamlessly make a book from mysocialbook. It connects to Instagram, Facebook, or google photos, you pick a time frame and it makes an easy keepsake for the year.

Let's make this the best year yet!

Now that you have managed to declutter your digital life, you are ready for a fresh year.

Comments